MCHD Tax Transparency

2025 Tax Rate

MOORE COUNTY HOSPITAL DISTRICT PROPOSES A TAX RATE THAT WILL RAISE MORE TAXES FOR “MAINTENANCE AND OPERATIONS” THAN LAST YEAR’S TAX RATE. THE TAX RATE WILL EFFECTIVELY BE RAISED BY 1.63% AND WILL RAISE TAXES ON A $100,000 HOME BY APPROXIMATELY $3..01

At the 08/27/25 Board of Directors meeting, the MCHD Board took into consideration the upcoming tax rate. The prior year’s rate was $0.240911/$100. After consideration of prior year uncompensated care, management proposes to decrease the tax rate to $0.23623 for the upcoming year.

The decision was based on the following information:

If the District kept the tax rate the same as prior year (0.240911) = Would result in a surplus of $823,307

If the District set the tax rate at the “Effective Rate” (0.232436) = Would result in a deficit of $122,200.09

If the District set the tax rate at the “Rollback Rate (0.251883) = Would result in a surplus of $503,928.49

The Management Suggested Rate (0.023623) = Would result in a deficit of $45.94

Taxes received by MCHD offset the amount of uncompensated care the District received the prior year. The verbiage “Maintenance and Operations” used in the legal notice are governmentally mandated. MCHD only uses taxes for the purpose of offsetting prior year uncompensated care. Instances when the tax rate is lowered but still results in an increase in taxes is due to how the county’s property valuations have been calculated. Moore County Hospital District strives to calculate to the best of its ability a tax rate that will be as close to the uncompensated care deficit as possible without creating either a loss or profit.

Tax Documents

Prior Year Tax Rate

2024 Tax Rate (Prior Year)

MOORE COUNTY HOSPITAL DISTRICT ADOPTED A TAX RATE THAT WILL RAISE MORE TAXES FOR MAINTENANCE AND OPERATIONS THAN LAST YEAR’S TAX RATE. THE TAX RATE WILL EFFECTIVELY BE RAISED BY 8.14% AND WILL RAISE TAXES FOR MAINTENANCE AND OPERATIONS ON A $100,000 HOME BY APPROXIMATELY $18.15

At the 08/28/24 Board of Directors meeting, the MCHD Board took into consideration the $2,941,317.00 increase in uncompensated care from prior year, which totaled $15,594,528.00. This was the main factor behind the decision to propose that the current rate of 0.228680/$100 be raised to 0.240911/$100.

The decision was based on the following information:

If the District kept the tax rate the same as prior year (0.228680) = Would result in a deficit of $475,000

If the District set the tax rate at the “Effective Rate” (0.222765) = Would result in a deficit of $661,835

If the District set the tax rate at the “Rollback Rate (0.240911) = Would result in a deficit of $88,663

The MCHD Board then held a special called, open to the public, meeting on 09/11/24 to discuss the proposed 2024/2025 tax rate with the community. As there were no members of the public in attendance, the Board moved forward to adopt the proposed tax rate and the rate was adopted at the 09/25/24 regularly scheduled Board meeting.

Taxes received by MCHD offset the amount of uncompensated care the District receives each year. The verbiage “Maintenance and Operations” used in the legal notice are governmentally mandated. MCHD only uses taxes for the purpose of offsetting uncompensated care.

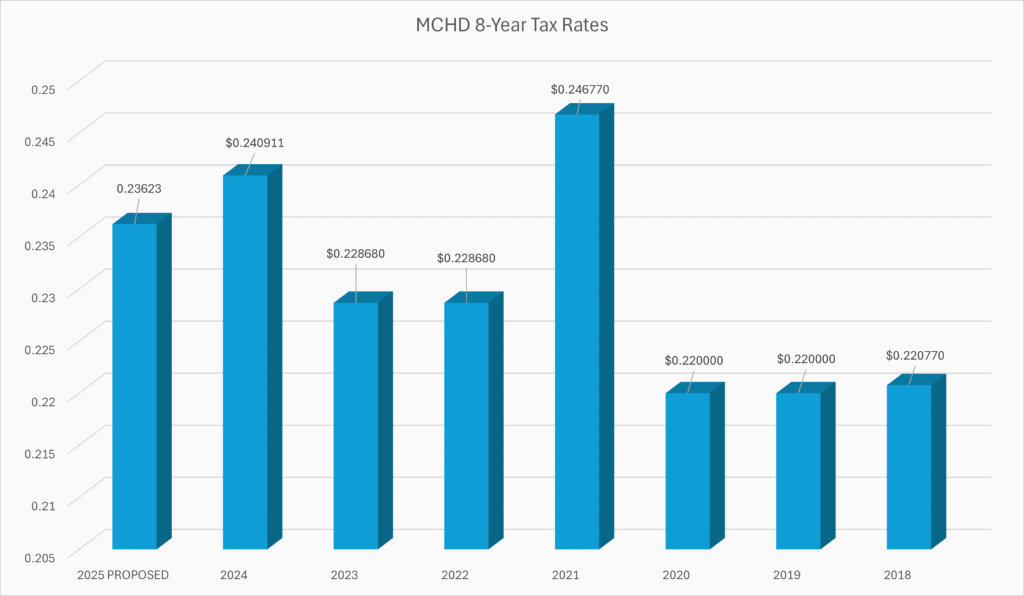

MCHD Tax Rate Comparison Including Current Year

MCHD’s tax rate comparison for prior years

2025 PROPOSED – $0.236230 per $100 (lowered from prior year)

09/27/2024 – $0.240911 per $100 (raised from prior year)

09/27/2023 – $0.228680 per $100 (same as prior year)

09/28/2022 – $0.228680 per $100 (lowered from prior year)

09/22/2021 – $0.246770 per $100 (raised from prior year)

09/23/2020 – $0.220000 per $100 (same as prior year)

09/25/2019 – $0.220000 per $100 (lowered from prior year)

09/26/2018 – $0.220770 per $100 (raised from prior year)

MCHD Tax Assessor/ Collector

Moore County Tax Assessor/ Collector

Chris A. Rivera

Physical Address:

500 South Dumas Ave

Dumas, TX 79029

Mailing Address:

PO Box 616

Dumas, TX 79029

Telephone: 806-935-2175

Fax: 806-935-2344

email: taxoffice@moore-tx.com

Website: www.co.moore.tx.us